How to Report Double Brokering: Your Complete Guide to Filing FMCSA Complaints and Protecting Your Freight

Jan 14, 2026

Scroll to explore

TLDR: What You Need to Know

Double brokering costs the freight industry $500-700 million annually, with complaints up 400% since 2022

File complaints through the FMCSA National Consumer Complaint Database (NCCDB) at nccdb.fmcsa.dot.gov or call 1-888-DOT-SAFT (1-888-368-7238)

Key red flags: mismatched BOL names, unusually high rates, carriers unfamiliar with load details, and generic email addresses

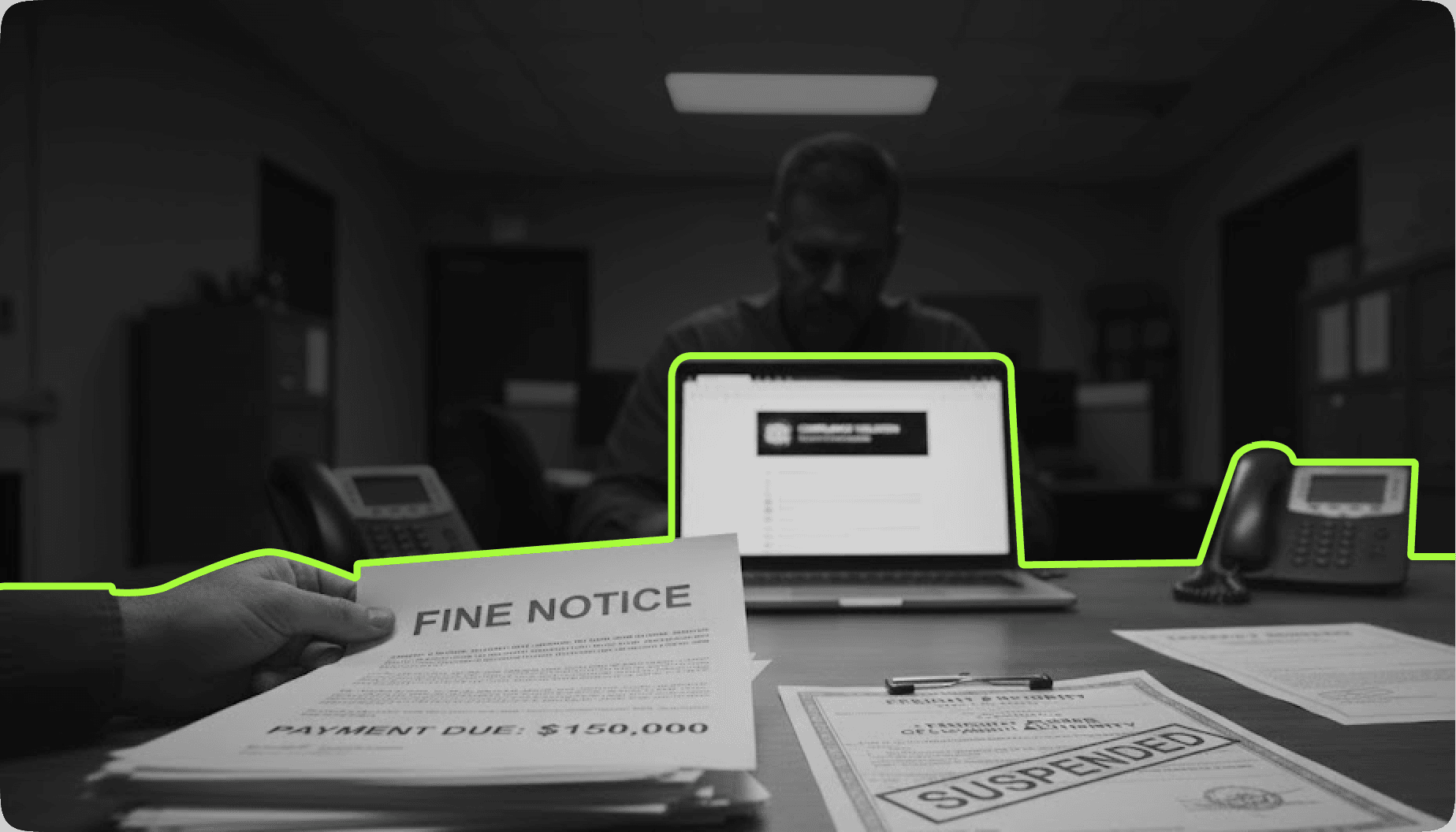

Penalties include fines up to $16,000 per violation, loss of operating authority, and potential criminal charges

Prevention requires continuous carrier verification, direct communication, and technology platforms that eliminate intermediary gaps

The Federal Motor Carrier Safety Administration just modernized their complaint database for the first time in years. The reason? Double brokering has exploded into a $700 million annual crisis, and the old system couldn't keep up.

Here's the problem: 85% of brokers and carriers report being impacted by double brokering. That means if you're moving freight, you've either been hit or you're next. The average company loses over $400,000 to these schemes—and most never see that money again.

But knowing how to report double brokering—and doing it correctly—changes everything. Your complaint becomes part of the broker's permanent record. It helps the FMCSA identify which companies to investigate. And it protects other shippers and carriers from falling victim to the same fraudulent broker.

This guide walks you through exactly how to identify double brokering, effectively report it to federal authorities, and implement the prevention strategies that make these scams structurally impossible.

What Is Double Brokering and Why Is It Illegal?

Double brokering occurs when a broker accepts a load from a shipper and then secretly transfers that shipment to another broker or carrier without the shipper's knowledge. This practice in the freight industry represents a fundamental breach of contract—and in most cases, outright fraud.

Here's how a typical double broker scheme works: A broker posts a load on an online load board. A second broker—often operating with stolen or purchased MC credentials—accepts that load. Instead of hauling it themselves, they re-broker it to an actual carrier at a lower rate, pocket the difference, and disappear before anyone gets paid.

Why is double brokering illegal? FMCSA regulations require transparency in freight transactions. When a broker re-brokers freight without disclosure, they violate federal law governing operating authority. More critically, it creates a liability nightmare: insurance coverage may not apply to the actual carrier hauling the load, leaving all parties involved exposed if something goes wrong.

Double Brokering vs Co-Brokering: Understanding the Difference

Factor | Double Brokering | Co-Brokering |

Shipper Consent | None—happens secretly | Disclosed and agreed upon |

Contract Terms | Violated | Written into agreement |

Insurance Coverage | May be voided | Maintained properly |

Legal Status | Illegal under FMCSA | Legal when documented |

Payment Risk | High—carriers often unpaid | Clear payment chain |

The distinction matters: co-brokering is a legitimate business practice when properly disclosed. Double brokering in the freight industry is fraud—and recognizing the difference is your first line of defense.

Key Takeaway: Double brokering is explicitly prohibited under federal regulations because it creates uninsured loads, untraceable freight, and unpaid carriers. When a broker accepts a load and re-brokers it without authorization, every party in the transaction faces financial and legal risk.

Now that you understand what makes this practice illegal, let's examine the warning signs that help you identify double brokering before it costs you money.

How to Identify Double Brokering Before It's Too Late

Truckstop reported a 400% increase in double brokering scams between late 2022 and early 2023. The Transportation Intermediaries Association now estimates these fraudulent activities affect $500-700 million in freight annually. But here's what the statistics don't tell you: most victims could have spotted the scam before it happened.

When you suspect double brokering, these are the red flags that should trigger immediate verification:

Documentation Red Flags

Mismatched names on the Bill of Lading: If the carrier name on your BOL doesn't match who you originally contracted with, a potential double brokering situation exists

Rate confirmations from different companies: Multiple rate confirmations for the same load signal multiple brokers handling your freight

Inconsistent shipper information: If details about pickup location, delivery schedules, or cargo specs don't match what you provided, the load has likely been passed around

Behavioral Warning Signs

Unusually high rate offers: Fraudulent broker entities often offer above-market rates to attract carriers. If a deal seems too good to be true, dig deeper

Carriers unfamiliar with load details: When the driver picking up your freight doesn't know basic information about the shipment, they likely received it through another broker

Pressure for immediate decisions: Double broker operations rely on speed to prevent verification. Legitimate brokers can wait while you confirm details

Generic email addresses: Gmail, Yahoo, or Hotmail addresses instead of company domains are immediate red flags for carriers and brokers alike

Verification Steps When You Suspect Fraud

Check SAFER: Verify the carrier's MC number through FMCSA's Safety and Fitness Records at safer.fmcsa.dot.gov

Call the verified number: Contact the carrier using the phone number listed in SAFER—not the number provided by the broker

Verify insurance independently: Contact the insurance company directly to confirm coverage is current and valid

Request direct driver contact: A reliable broker should provide direct communication with the assigned driver

Key Takeaway: Double brokering scams follow predictable patterns. The combination of documentation inconsistencies, behavioral red flags, and resistance to verification indicates a possible double brokering incident. Trust your instincts—and verify everything.

Once you've confirmed fraud has occurred, the next step is reporting it to the proper authorities. Here's exactly how to file a complaint with the FMCSA.

How to Report Double Brokering to the FMCSA

In 2025, the Department of Transportation announced a modernized National Consumer Complaint Database specifically designed to address freight scams like double brokering. This upgrade makes it easier than ever to report the incident and ensure bad actors face consequences.

To effectively report double brokering, follow these steps:

Step 1: Gather Your Evidence

Before filing, compile all relevant documentation:

Rate confirmations from the original broker you contracted with

Bills of lading showing mismatched carrier information

Email correspondence and communication records

Payment receipts or proof of non-payment

Screenshots from load boards or platforms showing the transaction

The broker's MC number, USDOT number, and contact information

Step 2: File Online Through the NCCDB

Visit the Federal Motor Carrier Safety Administration's complaint portal at nccdb.fmcsa.dot.gov. The updated system now includes a specific category for property brokers, making it straightforward to file a complaint with the FMCSA about double brokerage incidents.

When filling out the form:

Select "Freight Broker" as the complaint category

Choose "Deceptive Business Practice" or "Operating Authority and Financial Responsibility" as the violation type

Provide detailed descriptions of what happened, including dates and dollar amounts

Upload your supporting documentation

The process typically takes about 15 minutes. Your complaint becomes part of the broker's permanent record.

Step 3: Report to Additional Authorities

For comprehensive protection, also report fraud to:

DOT Office of Inspector General: Call 1-800-424-9071 or online at oig.dot.gov to report significant fraud

FBI Internet Crime Complaint Center: For fraud involving cyber elements like phishing or identity theft

State Attorney General: Many states have transportation fraud divisions

Industry databases: Report to Carrier411 FreightGuard, TIA Watchdog, and any load board platforms where the fraud occurred

Step 4: File a Bond Claim

If you haven't been paid, file a claim against the freight broker's surety bond. FMCSA requires brokers to maintain a $75,000 bond. While recovery from bond claims is often partial, it provides some financial recourse while the investigation proceeds.

Key Takeaway: Filing complaints through the proper channels creates accountability. The FMCSA uses these reports to determine which companies to investigate, and your documentation may be crucial to enforcement action.

So you've filed your complaint. But what actually happens next? Let's examine the investigation process and the penalties for double brokering that violators face.

What Happens After You Report Double Brokering?

Once you've submitted your complaint, the FMCSA initiates a review process. Understanding what happens next—and the potential penalties for double brokering—helps you set realistic expectations and know when to take additional action.

The Investigation Process

Your complaint enters the FMCSA system and becomes part of the broker or carrier's permanent record. The agency uses complaint data, along with other sources, to determine which companies warrant investigation. If FMCSA decides to take enforcement action, you may be contacted for additional information.

However, there's a limitation to understand: FMCSA's July 2024 report to Congress acknowledged that the agency lacks the statutory authority to administratively assess civil penalties for broker violations. This means FMCSA must seek adjudication through United States District Court for many enforcement actions—a process that takes time.

Penalties for Violations of FMCSA Regulations

Violation Type | Potential Penalty | Additional Consequences |

Operating without authority | Up to $16,000 per violation | Loss of brokerage authority |

Contract violations | Civil liability | Lawsuits from damaged parties |

Fraud or identity theft | Criminal prosecution | Federal prison time |

Bond requirement failure | $10,000+ fines | Revocation of operating rights |

Why Reporting Still Matters

Even with enforcement limitations, your complaint serves critical purposes. It creates a documented pattern that builds cases against repeat offenders. It alerts other brokers and carriers through industry databases. And it contributes to the data FMCSA uses to advocate for stronger regulatory authority.

The Owner-Operator Independent Drivers Association has been pushing for years to give FMCSA more enforcement teeth. Your complaints are part of that effort—they demonstrate the scope of the problem within the industry.

Key Takeaway: While federal enforcement has limitations, reporting creates accountability. Complaints build the record that leads to investigations, license revocations, and industry-wide warnings about specific bad actors.

But the best outcome is never needing to file a complaint in the first place. Let's look at how to prevent double brokering before you fall victim to these schemes.

How to Prevent Double Brokering Before You Need to Report It

When it comes to double brokering, prevention is infinitely more valuable than enforcement. Once your freight has been stolen or your carrier hasn't been paid, recovery is difficult and often incomplete. Smart operators build verification systems that make these schemes structurally impossible.

Due Diligence Checklist: Verify Broker Credentials Before Every Load

Verify operating authority: Check MC and USDOT numbers through SAFER before contracting

Confirm insurance coverage: Contact insurance companies directly—don't rely on certificates alone

Check complaint history: Review Carrier411, TIA Watchdog, and FMCSA complaint records

Verify physical address: A reliable freight brokerage has a verifiable business location

Require contract clauses: Include explicit language prohibiting unauthorized re-brokering

Operational Best Practices to Protect Your Business

Establish direct driver communication: Before pickup, get the driver's direct contact information and verify it matches the contracted carrier

Record vehicle information: Have your warehouse team document tractor and trailer plates, comparing them to contracted equipment

Implement real-time tracking: GPS visibility from pickup to delivery eliminates the blind spots where double brokering thrives

Avoid rate-only decisions: The cheapest option on the freight market is often the one that costs you most. Trustworthy freight partners rarely undercut the market significantly

Red Flags That Should Stop a Transaction

The broker may refuse to provide verifiable references

Payment requests to accounts that don't match the company name

Pressure to book immediately without time for verification

The carrier without proper documentation or resistance to providing ELD records

Multiple companies operating from the same IP address or phone number

Key Takeaway: Prevention requires both one-time vetting AND continuous verification. The freight market changes daily—a carrier that was legitimate last month may have had their credentials compromised today.

Manual prevention works, but it's time-consuming and error-prone. That's why technology platforms have become essential infrastructure for companies serious about protecting their freight.

Why Technology Is the Only Real Solution to Double Brokering

Here's the uncomfortable truth: manual verification can't keep pace with fraud. Criminals are using AI to generate fake documentation, compromising legitimate carrier accounts within minutes, and executing schemes across multiple states simultaneously. The traditional broker model—with its inherent information gaps and handoff points—creates the exact conditions fraud requires.

The Structural Problem

When a shipper works through traditional broker networks, their freight passes through multiple hands. Each handoff creates an opportunity for unauthorized re-brokering. Each broker in the chain adds complexity and reduces visibility. And when something goes wrong—as it does $700 million worth every year—untangling who's responsible becomes nearly impossible.

FreightWaves research shows that 78% of brokers identify fraud as one of the most time-consuming issues in their operations. Another 65% report significant productivity losses due to fraud-related disruptions. The logistics industries are spending enormous resources fighting a problem that technology can eliminate at the source.

What Modern Supply Chain Protection Looks Like

The solution isn't better fraud detection after the fact—it's building systems where fraud can't occur in the first place. That means eliminating the intermediary gaps where double brokering happens and implementing continuous verification that catches credential changes in real-time.

Effective platforms provide:

Real-time carrier verification: Checking credentials against FMCSA databases before every load, not just at onboarding

Continuous insurance monitoring: Automatic alerts when coverage lapses or changes

Direct shipper-carrier connections: Eliminating the intermediary layers where unauthorized re-brokering occurs

GPS tracking with anomaly detection: Identifying route deviations before cargo disappears

Tamper-evident documentation: Digital BOLs that can't be forged or manipulated

The ROI of Prevention

Companies using comprehensive carrier verification platforms report 97% reductions in double brokering incidents. When you compare that to the average $400,000 loss per successful fraud scheme, the math is straightforward: prevention technology pays for itself many times over.

Key Takeaway: The old model is broken. Fragmented broker networks, paper documentation, and one-time verification create the vulnerabilities criminals exploit. Technology platforms that provide continuous verification and direct connections don't just reduce fraud—they make it structurally impossible.

Build the Protection Your Freight Demands

Double brokering thrives in the gaps—between booking and pickup, between one freight broker and another carrier, between what's on paper and what's actually happening with your shipment. Every gap is an opportunity for fraud.

HaulerHub closes these gaps. Five-layer carrier verification that checks credentials before every load. Real-time GPS tracking with anomaly detection. Smart BOL technology that prevents document manipulation. And direct shipper-carrier connections that eliminate the intermediary handoffs where double brokering occurs.

Built by ITF Group—operators who run a $200M freight operation and built the platform they wished existed. We understand one freight fraud scheme can devastate a business, because we've been targets ourselves.

Ready to stop paying the freight fraud tax?

Contact HaulerHub to see how verified direct connections protect your freight.

Checkout other blogs

Stay ahead of the supply chain.

Break free from costly and complex systems. Sign up with HaulerHub now and make shipping a breeze.