Best Convoy Alternatives in 2025: Digital Freight Platforms Compared

Dec 24, 2025

Scroll to explore

TL;DR: Convoy shut down in October 2023, leaving thousands of shippers searching for alternatives to Convoy. Most Convoy competitors are still digital brokerages charging 15-25% markups on freight shipping. The real question isn't which freight marketplace to switch to—it's whether you need shippers and freight brokers at all. Direct connection platforms eliminate the middleman entirely, helping you manage freight more efficiently while cutting costs by up to 60%. This guide compares the best Convoy alternatives in 2025 so you can find the best shipping carriers and rates for your truckload freight operations.

If you're reading this, you probably got burned. Or at least caught off guard when the largest truckload freight marketplace collapsed overnight.

When Convoy shut down in October 2023, it left thousands of shippers scrambling to find new ways to book shipments and manage freight transportation. A $3.8 billion valuation. Backing from Jeff Bezos and Bill Gates. Over 80,000 motor carriers in their network. Gone—along with millions in unpaid freight invoices.

The freight market's response? A flood of "Convoy alternative" lists pointing you toward other digital freight platforms. Uber Freight. Transfix. C.H. Robinson's transportation management software. The same middleman model with a different logo—and the same 15-25% markup on every shipment.

Here's what those lists won't tell you: Convoy didn't fail because digital road freight logistics doesn't work. It failed because the digital brokerage model is fundamentally broken. You can't digitize inefficiency and expect different results in the trucking and logistics industry.

This guide takes a different approach. We'll compare Convoy competitors and alternatives honestly—including the fee structures most providers don't advertise—and help you answer a bigger question: Do you want a better broker, or do you want to connect shippers with their carriers directly?

What Happened to Convoy (And Why Freight Shipping Changed in 2025)

Understanding Convoy's failure isn't about industry gossip—it's about avoiding the same trap when choosing among alternatives to Convoy for your freight shipping needs.

On October 19, 2023, Convoy CEO Dan Lewis sent a memo to employees that began with the words, "We hoped this day would never come." The leading freight marketplace was shutting down immediately. Most of the 500 remaining employees were laid off that day with no severance. Freight carriers were left with unpaid invoices—some motor carriers owed more than $100,000 for loads already delivered.

The official explanation cited a "massive freight recession" and "dramatic monetary tightening" affecting the entire freight market. That's true—but incomplete.

The deeper issue: Convoy was still operating as shippers and freight brokers in the middle. A technologically sophisticated broker with impressive algorithms and slick interfaces, but a middleman nonetheless. When margins compressed during the freight recession, there was nowhere to cut costs without cutting into the very markup that funded freight transportation operations.

As FreightWaves reported, the company faced a "perfect storm"—but that storm exposed a structural weakness in the trucking and logistics business model. Digital brokerages face the same fundamental economics as traditional ones. They just process freight shipping faster.

What this means for shippers: Any freight marketplace that depends on broker margins will face the same pressures when freight market conditions tighten. The question isn't whether the next recession will stress your transportation management system—it's whether your platform's model can survive it while helping you manage freight effectively.

Key Insight: Convoy processed over $1 trillion in freight over its lifetime and built one of the most advanced software solutions in digital road freight. The technology worked. The economics of shippers and freight brokers didn't.

What to Look for in Alternatives to Convoy

Most platform comparisons focus on features when evaluating Convoy alternatives. Shippers who've been through a platform collapse know that sustainability matters more than bells and whistles in freight transportation.

Pricing Transparency and Accurate Spot Market Rates

Ask any freight marketplace directly: What percentage do you take from each shipment? If the answer is vague—"market rates," "competitive pricing," "it depends"—that's your first red flag. Traditional freight brokers take 15-30%. Digital brokerages typically charge 15-20%. Direct connection platforms that connect shippers with their carriers operate on flat fees or single-digit percentages with accurate spot market rates.

Carrier Network Verification

Freight fraud has exploded since 2020—strategic cargo theft increased 430% between 2022 and 2024. Your platform's motor carrier vetting process isn't a feature; it's a requirement for secure freight shipping. Look for multi-layer verification: DOT authority, insurance validation, safety scores, business legitimacy checks, and driver screening before you can book shipments with any freight carrier.

Real-Time Visibility for the Entire Freight Journey

"Tracking" means different things on different freight platforms. Some offer GPS location updates. Others provide estimated arrival windows. The gold standard to support the entire freight journey: continuous GPS-enabled fleet tracking, direct driver communication, and proactive alerts for delays or route deviations. This level of visibility helps you manage freight transportation with confidence.

Transportation Management System Integration

Your existing transportation management software shouldn't require rebuilding when you switch Convoy alternatives. Evaluate API/EDI integration options, compatibility with your current workflow and business processes, and implementation timeline. The best freight platforms offer free integration support with your cloud-based TMS—because they want you operational, not stuck in setup limbo. Look for software solutions that work with your existing business rules.

Business Model Sustainability

This is the lesson Convoy taught the logistics industry. A platform burning through venture capital to subsidize low freight rates isn't sustainable. Look for platforms with clear unit economics—leading providers that can operate profitably without depending on the next funding round while still delivering market trends and data insights.

With these criteria in mind, let's examine how the major Convoy competitors and alternatives actually stack up for truckload freight operations.

Best Convoy Alternatives in 2025: Competitors and Alternatives Compared

The freight platforms below represent the primary alternatives to Convoy that shippers are evaluating in 2025. We've organized them by model type—because the model determines everything else about how you'll manage freight and book shipments online.

Platform | Model Type | Typical Markup | Best For | Key Limitation |

|---|---|---|---|---|

HaulerHub | Direct Connection | 7% to carrier + $5/load to shipper | Shippers wanting full control & transparency | Requires shipper engagement in carrier selection |

Uber Freight | Digital Broker | 15-20% | High volume, automated booking | Same margin structure as traditional brokers |

Transfix | AI-Driven Broker | 15-20% | Enterprise shippers, lane optimization | Still a brokerage; shipper pays full markup |

C.H. Robinson | Traditional + Tech | 20-25% | Complex logistics, global reach | Highest cost; legacy infrastructure |

Banyan Technology | TMS Software | Subscription + carrier fees | Multi-carrier rate shopping | Requires carrier relationships; software only |

Echo Global | Hybrid Broker | 18-22% | Multi-modal shipping needs | Tech layer over traditional model |

HaulerHub: Direct Connection Platform for Shippers and Carriers

HaulerHub operates on a fundamentally different model than other Convoy alternatives—connecting shippers directly with their carrier partners and eliminating the broker layer entirely. Instead of taking a percentage of each shipment like traditional shippers and freight brokers, the platform charges freight carriers a 7% platform fee and shippers just $5 per booked load. This software solution helps find the best shipping carriers while keeping costs transparent.

Five-layer carrier network compliance verification eliminates freight fraud risk

Direct in-cabin driver communication to support the entire freight journey

Free API/EDI integration with existing transportation management software and cloud-based TMS

24/7 human support—no chatbots, no phone trees

Compare price quotes and book shipments online with full transparency

Uber Freight: Digital Freight Brokerage

Uber Freight brought the ride-sharing company's technology approach to the trucking and logistics industry—instant quotes, automated booking, and a large carrier network. It's one of the most polished digital road freight experiences available among Convoy competitors.

Strong technology infrastructure helps shippers book shipments quickly

Large carrier network of integrated carriers for capacity availability

Still operates on broker margins (15-20% typical) like traditional freight forwarders

Parent company has faced profitability pressures across divisions

Transfix: AI-Driven Freight Matching

Transfix emphasizes machine learning for freight matching and pricing optimization in the freight marketplace. The platform targets enterprise shippers with dedicated capacity programs and lane-specific pricing to optimize your freight carrier selection.

Advanced AI provides market trends and data insights for freight transportation

Strong enterprise integrations with existing management systems

Brokerage model means shippers still pay full markup on freight shipping

Best suited for high-volume enterprise freight operations

C.H. Robinson (Navisphere): Traditional + Tech for Complex Logistics

The leading provider and largest freight brokerage in North America has invested heavily in its Navisphere transportation management system. It offers global reach and comprehensive services for managing complex logistics networks—at traditional broker pricing. Their platform handles international air and ocean freight rates alongside domestic truckload freight.

Massive carrier network including freight forwarders and global capabilities

Full-service logistics support for the entire freight journey

Highest cost structure among Convoy alternatives (20-25% markups)

Technology layer over legacy brokerage operations

Banyan Technology: Leading Freight Management System

Banyan Technology offers a leading freight management system that helps shippers compare freight rates backed by their network of integrated carriers. Unlike full-service brokers, Banyan Technology provides transportation management software that lets you search hundreds of top shipping options and compare price quotes—but you'll need existing carrier relationships or broker partnerships to actually book shipments online.

Cloud-based TMS with automated freight auditing and real-time business intelligence

Helps find the best shipping carriers across multiple modes

Software solution for midsize freight operations with complex workflow needs

Requires separate carrier relationships—not an all-in-one freight marketplace

Let's break down exactly what these different pricing models mean for your freight shipping budget in 2025.

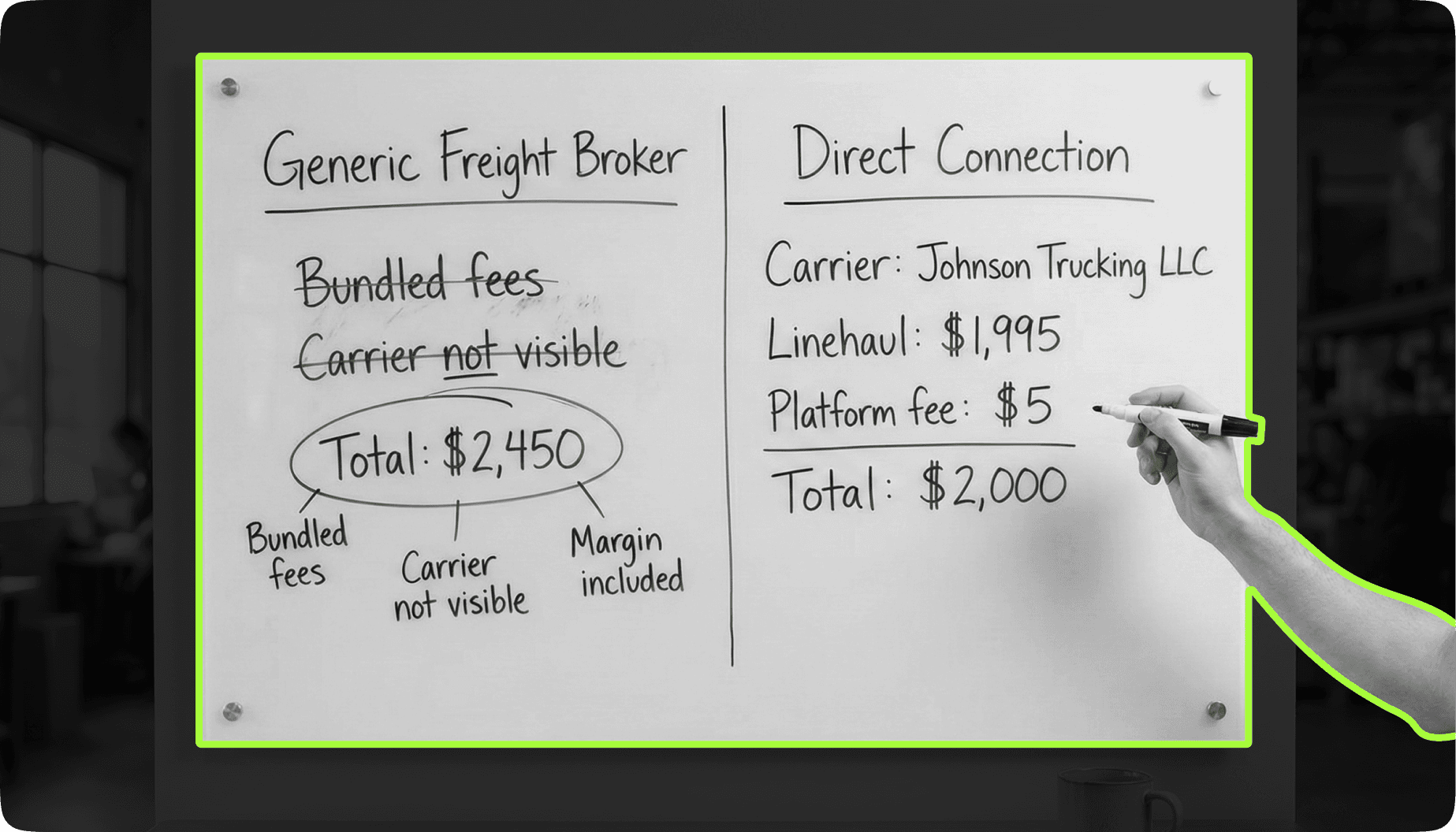

Freight Shipping Costs: What Convoy Alternatives Actually Charge

Platform comparisons typically focus on features. But features don't hit your P&L—pricing does. Understanding the true cost helps you manage freight expenses and find the best shipping carriers and rates among alternatives to Convoy.

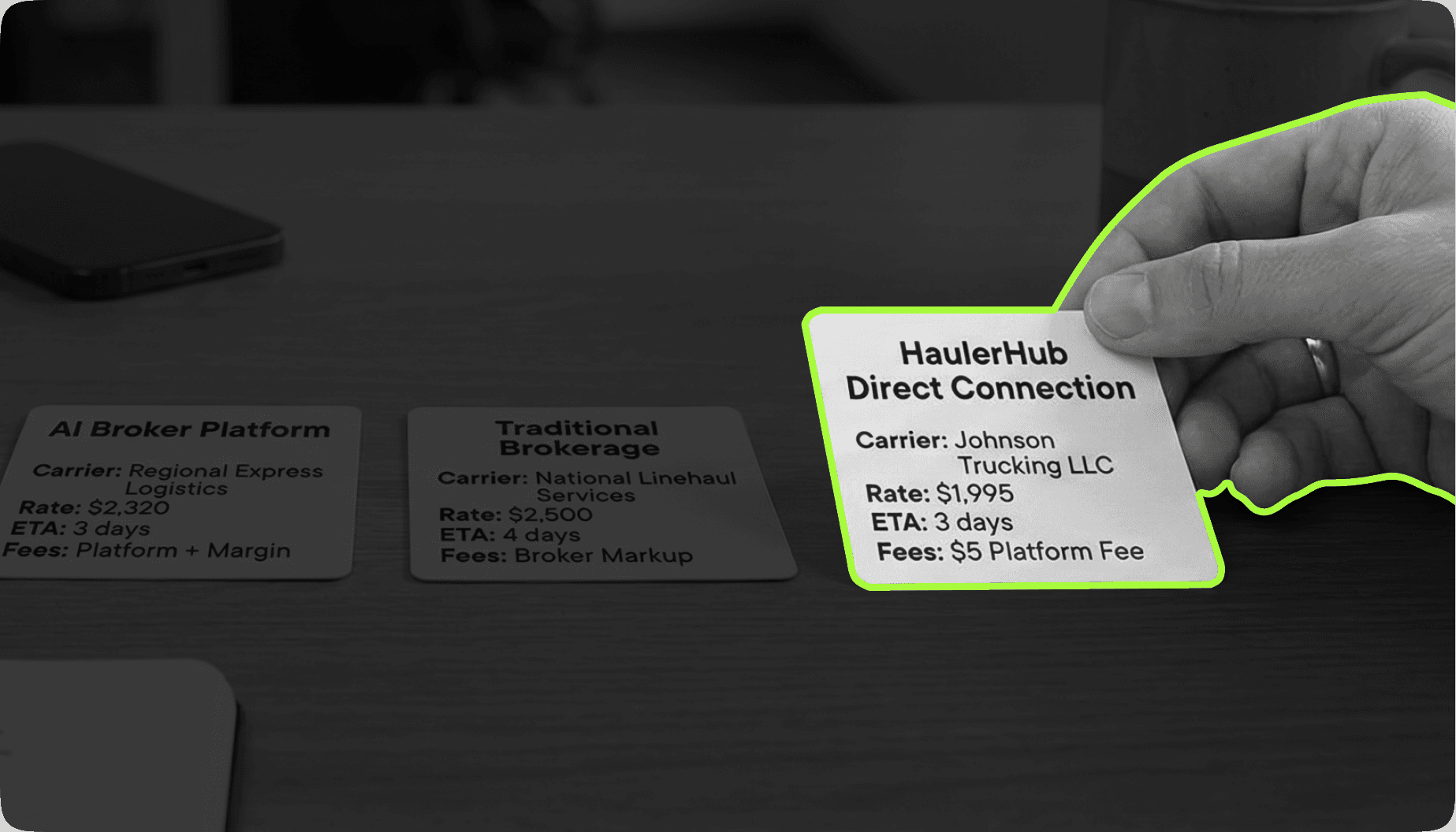

Consider a $2,000 truckload freight shipment across these best Convoy alternatives:

Platform | Shipper Pays | Carrier Receives | Platform/Broker Take |

|---|---|---|---|

Traditional Broker | $2,600 | $2,000 | $600 (30%) |

C.H. Robinson | $2,500 | $2,000 | $500 (25%) |

Uber Freight/Transfix | $2,360 | $2,000 | $360 (18%) |

HaulerHub | $2,005 | $1,860 | $145 (7% + $5) |

At 100 loads per month, the difference between traditional shippers and freight brokers versus a direct connection platform is over $45,000 annually. That's not optimization—that's transformation of your freight transportation budget.

According to Grand View Research, the digital freight brokerage market is projected to grow from $5.87 billion in 2024 to $24.36 billion by 2030—a 27.3% compound annual growth rate. Industry analysts rely on these market trends and data insights to understand how the freight market is evolving. That growth represents shippers moving away from traditional models. The question is whether they're moving toward slightly better brokers or eliminating the broker model entirely.

The numbers raise a fundamental question about the trucking and logistics industry's future—which brings us to the real decision you're facing when evaluating Convoy alternatives.

Convoy Alternatives: Better Freight Broker or No Broker?

Most best Convoy alternatives guides assume you need shippers and freight brokers in the middle. That assumption deserves examination for anyone serious about optimizing freight shipping costs in 2025.

The case for digital freight brokers:

Hands-off shipping management for busy operations

Access to large carrier networks without direct relationship building

Familiar workflow for teams accustomed to working with freight forwarders

Can handle international air and ocean freight rates alongside domestic

The case for direct connection platforms:

Dramatic cost reduction (often 50%+ savings on platform fees for freight shipping)

Complete visibility into carrier relationships and accurate spot market rates

Reduced freight fraud risk through direct motor carrier verification

Better carrier relationships (freight carriers keep more of what shippers pay)

Platform economics that don't depend on freight market conditions

Book shipments online with major integrated carriers directly

Here's what the Convoy collapse revealed to the logistics industry: Digital brokers improved the user experience of freight brokerage without fixing the underlying economics. When margins compressed, even the best-funded, most technologically sophisticated broker in the freight marketplace couldn't survive.

Direct connection platforms operate differently. Because they don't depend on broker margins, they can offer sustainable pricing regardless of freight market conditions. Shippers pay less, motor carriers earn more, and the platform operates on predictable fee revenue rather than variable markup—creating a solution for midsize freight operations and enterprise shippers alike.

The right Convoy alternative depends on your priorities:

Choose a digital broker if you value hands-off shipping management over cost savings and your truckload freight volume doesn't justify the attention.

Choose a direct platform if you want maximum cost reduction, full transparency, and a model that aligns shipper, freight carrier, and platform incentives.

Once you've made that strategic decision, migration becomes straightforward. Let's walk through the workflow for switching to the best Convoy alternatives in 2025.

How to Switch to the Best Convoy Alternatives in 30-60 Days

Whether you're switching between Convoy alternatives or moving from traditional shippers and freight brokers to direct connections, the migration process follows similar steps. The timeline depends on your freight transportation complexity and internal readiness.

Week 1-2: Assessment and Setup

Audit your current freight data: lanes, volumes, freight carriers, rates

Create accounts on your target freight marketplace platforms

Evaluate transportation management system integration requirements

Identify priority lanes for initial testing to post freight on your lanes

Week 3-4: Parallel Testing

Run a subset of loads (10-20%) through the new platform while maintaining your existing business processes. Compare pricing against accurate spot market rates, service quality, and operational fit for your workflow. This isn't just about cost—it's about whether the software solution works with your shipping management needs.

Week 5-8: Gradual Transition

Increase new platform volume based on parallel test results. Most shippers find that ramping from 20% to 80% over four weeks provides enough data to identify issues without disrupting freight shipping operations. During this phase, you'll learn to compare price quotes and book shipments online with confidence.

Ongoing: Optimization

Track performance metrics: cost per mile, on-time delivery, carrier network quality scores. Direct platforms often reveal savings opportunities that weren't visible when broker margins obscured the true cost structure of your freight transportation. Use market trends and data insights to continuously optimize your freight carrier selection.

Pro Tip: Don't try to migrate all truckload freight at once. Start with your highest-volume, most predictable lanes where you can easily find the best shipping carriers. Save complex or time-sensitive freight for after you've established operational confidence with your new Convoy alternative.

With a clear migration path established, let's bring this together with a framework for choosing the best Convoy alternatives in 2025.

Choosing the Best Convoy Alternatives for Freight Shipping in 2025

Convoy's collapse wasn't just a company failure—it was a signal that the trucking and logistics industry's middleman model is reaching its limits. The freight market is demanding better solutions for freight shipping.

The digital freight brokerage market is growing at 27% annually because shippers are demanding better ways to manage freight. But "better" means different things to different freight shipping operations in 2025.

Key Takeaways for Choosing Alternatives to Convoy:

1. Convoy failed because digital freight brokers face the same margin pressures as traditional shippers and freight brokers—technology alone doesn't fix broken economics in the freight marketplace.

2. Most Convoy competitors and alternatives are still brokers. Uber Freight, Transfix, and traditional freight forwarders offer better technology but the same 15-25% markup structure on freight shipping.

3. Direct connection platforms like HaulerHub represent a structural shift in freight transportation—eliminating the broker layer entirely rather than digitizing it, so shippers connect with their carrier partners directly.

4. Transportation management software like Banyan Technology can help you compare price quotes and book shipments online, but you'll need carrier relationships to actually move truckload freight.

5. Migration to a new freight platform can be completed in 30-60 days with proper planning and parallel testing of your shipping management workflow.

The freight market will continue evolving in 2025 and beyond. Platforms will rise and fall in the logistics industry. The shippers who thrive will be those who chose the best Convoy alternatives built for sustainability rather than growth-at-all-costs—finding ways to book shipments with reliable motor carriers while maintaining accurate spot market rates.

Ready to See the Difference Direct Connections Make?

Compare your current freight shipping costs against HaulerHub's direct connection model.

No pressure. No sales pitch. Just the math to help you find the best shipping carriers and rates.

Checkout other blogs

Stay ahead of the supply chain.

Break free from costly and complex systems. Sign up with HaulerHub now and make shipping a breeze.